florida death inheritance tax

While many states have inheritance taxes Florida does not. If the decedent was unmarried at the time of death and left no will but had one or more surviving descendants those descendants receive the entire estate.

Florida Inheritance Tax and Gift Tax.

. Call us at 904-264-3627 today. Spouses in Florida Inheritance Law. You have to pay taxes on the 100000 gain.

Mom dies in 2012 when the house was worth 100000 and you inherit the house. Moreover Florida does not have a state estate tax. To the extent its assets exceed the 1118 million exemption as of 2018 an estate is taxed at a marginal rate of up to 40.

Florida doesnt have an inheritance or death tax. This tax is different from the inheritance tax which is levied on money after it has been passed on to the deceaseds heirs. There is no inheritance tax in Florida because the property that is inherited does not count as income for the federal tax guidelines.

Florida also does not have a separate state estate tax. Nonetheless Florida residents may still have to pay inheritance tax when they inherit property from someone else. This means if your mom leaves you 400000 you get 400000 there are no taxes to pay.

Inheritance Law for Unmarried Decedents. Also a Florida resident or any resident of the United States may pay an unlimited. There isnt a limit on the amount you can receive either any money you receive as an inheritance is tax-free at the state level.

The Federal government imposes an estate tax which begins at a whopping 40this would wipe out. The bad news is that the United States federal government does have an estate tax. Some people are not aware that there is a difference however the difference between the two relates to who is responsible for paying the taxes on them.

You can contact us at Arnold Law to explore your options for navigating the estate and inheritance process. The federal government then changed the credit to a deduction for state estate taxes. Florida Statute sections 732102 and 732103 specifically determine how a decedents property is divided when they die without a will under the 2022 Florida Probate Rules.

Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005. If someone dies and leaves behind a spouse who they were legally married to at the time of death the spouse is first in line to inherit everything. Florida doesnt collect inheritance tax.

If the married. If there were no children either from the couple or from the deceaseds previous relationship then the surviving spouse is the sole heir. If youre concerned about passing your property to your heirs because of taxes dont be concerned.

This law came into effect on Jan 1 2005. For multiple descendants Florida law divides the probate assets along generational lines. Federal Estate Tax.

You may have heard the term death tax but estate tax is the legal term. Florida doesnt have an inheritance or death tax. Federal estate taxes are only applicable if the total estates value exceeds 117 million as of 2021.

Most assets devised through a will inheritance process will not result in tax liability. You sell the house after she dies. There is no federal inheritance tax but there is a federal estate tax.

In Florida there are no estate or inheritance taxes. Federal Estate Taxes. Florida does not have a separate inheritance death tax.

Estate taxes are paid by the estate before the. Sometimes referred to as the death tax or inheritance tax what is the inheritance tax or estate tax. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40.

22 the estate tax exemption was then increased in 200000 increments to reach 3. 2 Inheriting at death is good because of stepped up basis. In Pennsylvania for instance the inheritance.

Estate tax is a tax levied on the estate of a person who owned property upon his or her death. If someone dies in Florida Florida will not levy a tax on their estate. However it is important to be aware that while there is no inheritance or estate tax the executor will still have to do the following.

Florida does not have a separate death or inheritance tax. If all the decedents children survive the estate is. The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the lifetime limit 11700000 in 2021.

There is no inheritance tax in Florida but other states inheritance taxes may apply to you. Previously federal law allowed a credit for state death taxes on the federal estate tax return. Its against the Florida constitution to assess taxes on inheritance no matter how much its worth.

An inheritance tax is a tax levied against the property someone receives as an inheritance. For Florida residents and Florida citizens the good news is that the does not have a Florida inheritance tax or an estate tax. Inheritance Tax in Florida.

As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax. Mom buys the house in 1980 for 10000. The tax that is incurred is paid out by the trustestate and not the beneficiaries.

However the federal government does impose an estate tax that applies to all residents of all states but it only applies if the value of. So if the appraiser values your home at 300000 and the property tax rate is two percent you will owe 6000. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax.

An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary not the estate. The laws surrounding inheritance and estate taxes in Florida are complex and it could be hard to understand your options without the assistance of an inheritance attorney. In 2012 Mom deeds the house worth 110000 BEFORE she dies.

However the federal government imposes estate taxes that apply to all residents. Florida doesnt collect inheritance tax.

Florida Last Will And Testament Form Last Will And Testament Will And Testament Estate Planning Checklist

Free End Of Life Checklist Life Binder Estate Planning Checklist Emergency Binder

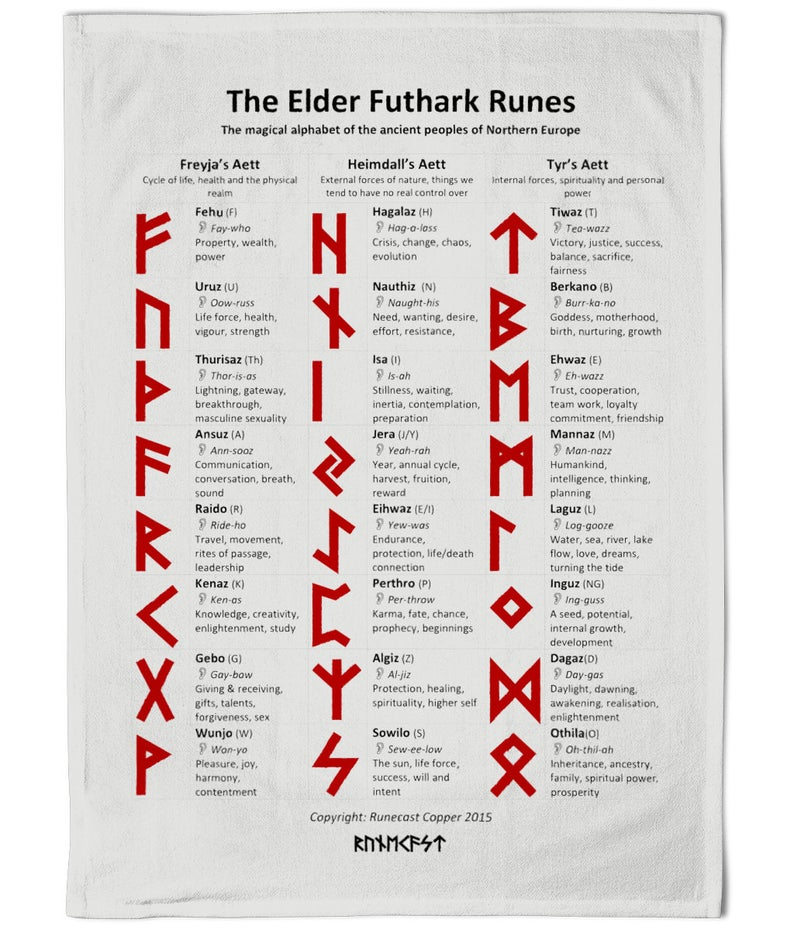

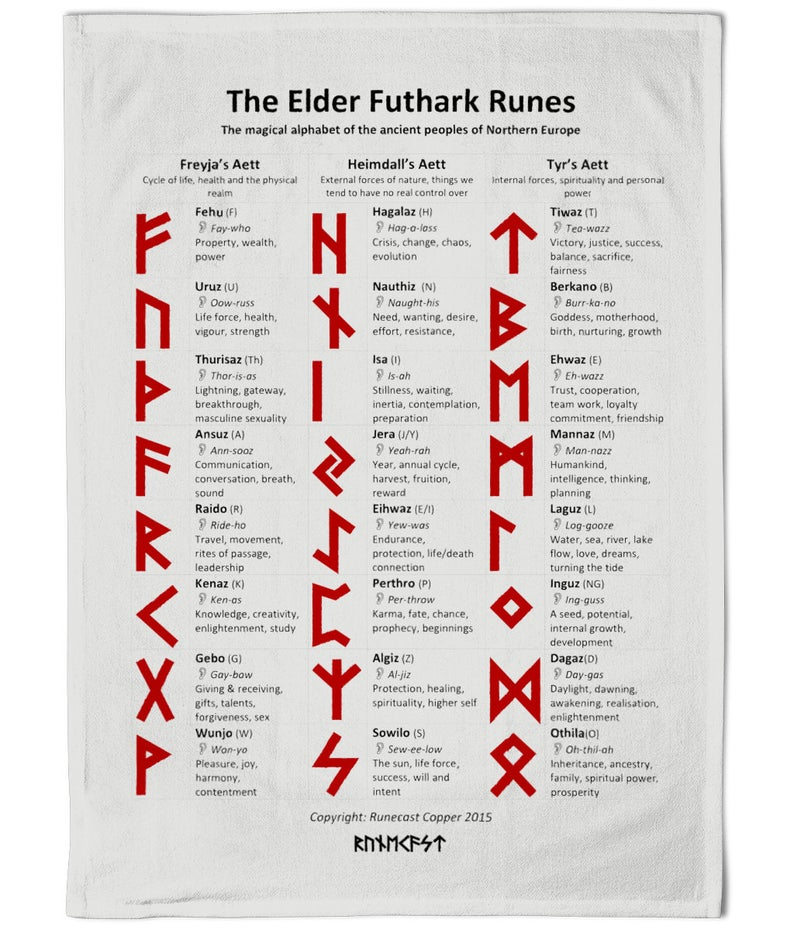

Runes Tea Towel Elder Futhark Runes Cotton Kitchen Towel Etsy Elder Futhark Runes Futhark Runes Elder Futhark

Reason To Make An Estate Plan 37 Estate Planning Checklist Estate Planning How To Plan

Estate Planning Decoded Visual Ly Estate Planning Checklist Estate Planning Funeral Planning Checklist

Pin By Kay Reeves On My Death Book Estate Planning Checklist Funeral Planning Funeral Planning Checklist

A Person May Want To Disclaim An Inheritance Or Gift In Order To Maximize Gift And Estate Tax Exclusions Or Simply Because He O Inheritance Estate Tax Estates

21 Step Estate Planning Checklist Odgers Law Group Estate Planning Law Estate Planning Checklist Estate Planning Funeral Planning Checklist

Bequeathed Sample Letter For Gold Bars Lettering Skyrim Elder Scrolls

Getting A Real Estate Appraisal Is Only One Step For The Estate Executor S Duties Estate Executor Estate Planning Checklist Funeral Planning Checklist

Printable Sample Last Will And Testament Form Last Will And Testament Will And Testament Legal Forms

Estate Planning Is Useful For Anyone Who Wants To Leave An Effective And Carefully Legacy Assurance Plan Estate Planning Checklist How To Plan Estate Planning

Best California Last Will And Testament Template Word Last Will And Testament Will And Testament Templates Printable Free

Estate Planning Checklist Estate Planning Checklist Funeral Planning Checklist Funeral Planning

The Legal Steps And Timeline For A Testamentarytrust And Duties Of A Trustee Testamentary Trust Estate Planning Checklist Trust

Legacy Assurance Plan Pointing About The Federal Estate Tax And How This Tax May Affect Larger Estate Planning Estate Planning Checklist Revocable Living Trust

Estate Planning Estate Planning Estate Planning Checklist How To Plan

Funeral Planning Checklist Template Beautiful Best 25 Funeral Planning Ideas On Pinterest Estate Planning Checklist Funeral Planning Checklist Funeral Planning

How To Set Up A Trust In Wisconsin Estate Planning Checklist Setting Up A Trust Budgeting Money