omaha nebraska sales tax rate 2021

Papillion NE Sales Tax Rate. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

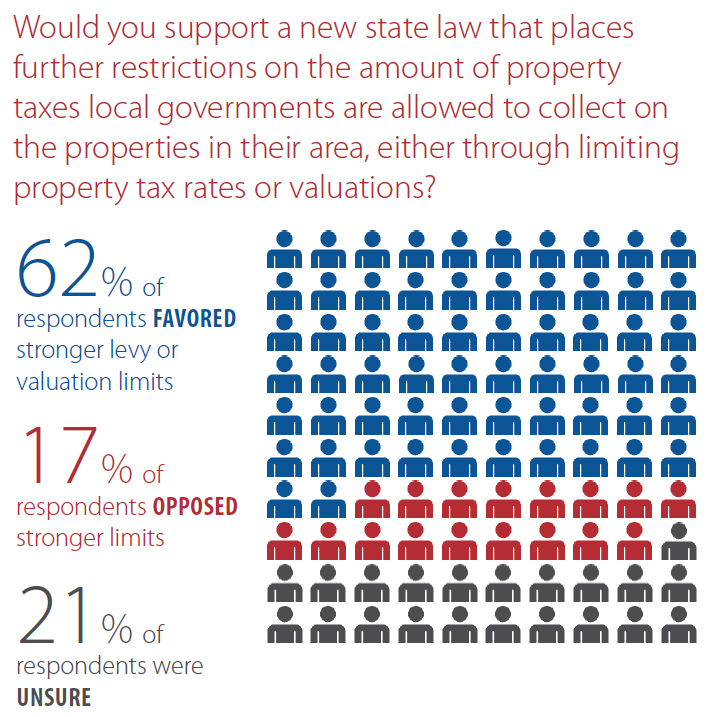

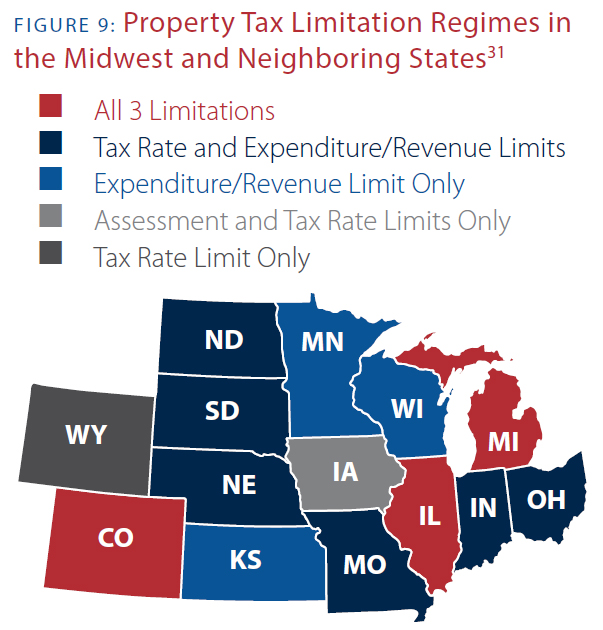

Get Real About Property Taxes 2nd Edition

The local sales tax rate in Omaha Nebraska is 7 as of May 2022.

. May 2022 7. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. Did South Dakota v.

Omaha collects the maximum legal local sales tax. Month Combined Tax State Tax County Tax City Tax Special Tax. 31 rows The latest sales tax rates for cities in Nebraska NE state.

Omaha NE Sales Tax Rate. Omaha collects a 15 local sales tax the. The minimum combined 2022 sales tax rate for Gothenburg Nebraska is.

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. This is the total of state county and city sales tax rates. The Columbus sales tax rate is.

The Nebraska sales tax rate is currently. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. The Nebraska sales tax rate is currently.

You can print a 825 sales tax table here. The Nebraska sales tax rate is currently. The Nebraska state sales and use tax rate is 55 055.

The Ord sales tax rate is. Changes in Local Sales and Use Tax Rates Effective January 1 2021. 2020 rates included for use while preparing your income tax deduction.

31 rows The state sales tax rate in Nebraska is 5500. Average Sales Tax With Local. The minimum combined 2022 sales tax rate for Columbus Nebraska is.

The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha. Groceries are exempt from the Omaha and Nebraska state sales taxes. State Tax Rates.

4 hours agoThe Environmental Protection Agency said it would set the 2022 levels for corn-based ethanol blended into gasoline at 15 billion gallons. The County sales tax rate is. The Gothenburg sales tax rate is.

The 825 sales tax rate in Omaha consists of 625 Texas state sales tax 05 Morris County sales tax and 15 Omaha tax. Thursday July 01 2021. This is the total of state county and city sales tax rates.

The Total Rate column has an for those municipalities in Gage County that have an. There is no applicable special tax. Wayfair Inc affect Nebraska.

For tax rates in other cities see Texas sales taxes by city and county. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. The Nebraska sales tax rate is currently.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed. The minimum combined 2022 sales tax rate for Gretna Nebraska is. Rates include state county and city taxes.

Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each impose a tax rate of 05. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. The County sales tax rate is.

This is the total of state county and city sales tax rates. The current total local sales tax rate in Omaha NE is 7000. See the County Sales and Use Tax Rates section at the end of this listing for information on how these counties are treated differently.

Nebraska sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The base state sales tax rate in Nebraska is 55. Local Sales and Use Tax Rates Effective January 1 2021 Dakota County and Gage County each impose a tax rate of 05.

The County sales tax rate is. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. The Nebraska state sales and use tax rate is 55 055.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective April 1. But even as the new rules increased future ethanol. Did South Dakota v.

Historical Sales Tax Rates for Omaha. The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax. Groceries are exempt from the Nebraska sales tax.

The Nebraska sales tax rate is currently 55. See the County Sales and Use Tax Rates section at the end of this listing for information on how these counties are treated differently. The Nebraska sales tax rate is currently.

Plattsmouth NE Sales Tax Rate. The County sales tax rate is. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022 Updated 03032022 There are no changes to local sales and use tax rates that are effective July 1 2022.

Did South Dakota v. This is the total of state county and city sales tax rates. The Gretna sales tax rate is.

The December 2020 total local sales tax rate was also 7000. Nebraska has 149 special sales tax jurisdictions with local sales taxes in addition to the state. Wayfair Inc affect Nebraska.

Find your Nebraska combined state and local tax rate. The minimum combined 2022 sales tax rate for Ord Nebraska is. The Total Rate column has an for those municipalities.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. What is the sales tax rate in Ord Nebraska. Wayfair Inc affect Nebraska.

There are a total of 334 local tax jurisdictions across the state collecting an average local tax of 0825.

Which Cities And States Have The Highest Sales Tax Rates Taxjar

These Are The Best And Worst States For Taxes In 2019

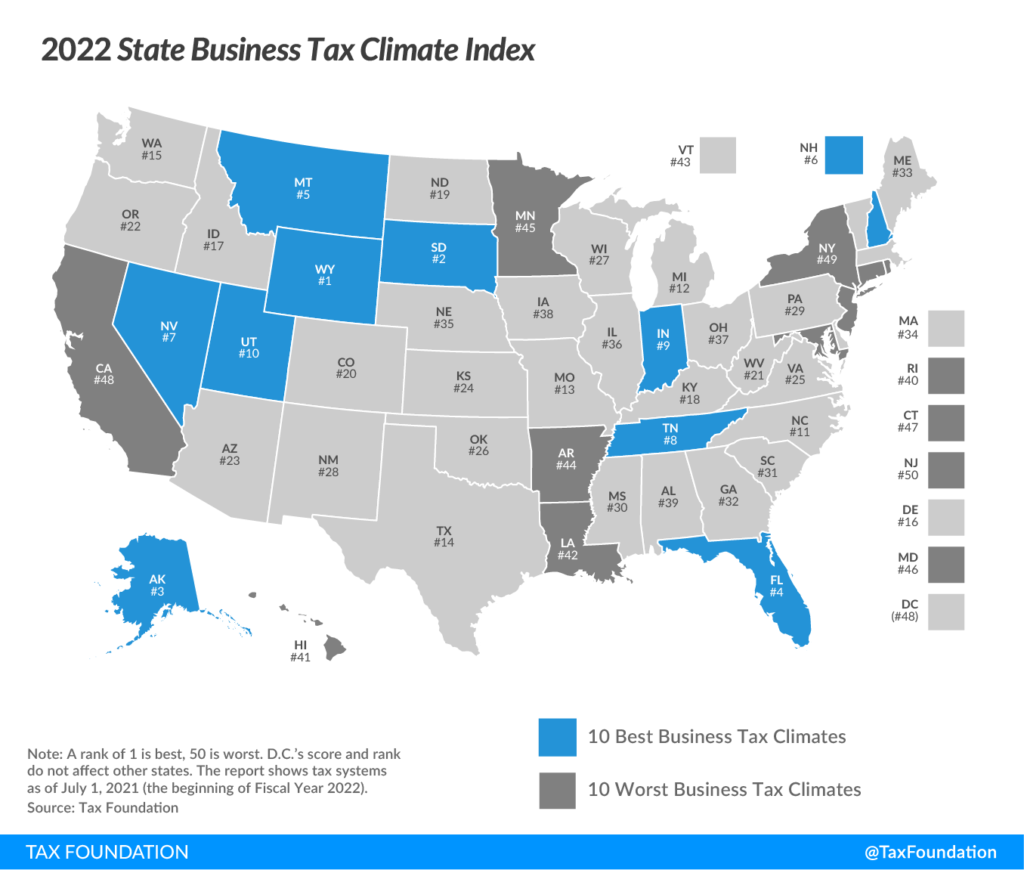

Nebraska Drops To 35th In National Tax Ranking

How High Are Cell Phone Taxes In Your State Tax Foundation

Taxes And Spending In Nebraska

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Get Real About Property Taxes 2nd Edition

New Ag Census Shows Disparities In Property Taxes By State

General Fund Receipts Nebraska Department Of Revenue

Nebraska Sales Tax Rates By City County 2022

Compared To Rivals Nebraska Takes More From Taxpayers

Taxes And Spending In Nebraska

Sales Taxes In The United States Wikiwand

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Where S My Nebraska State Tax Refund Taxact Blog